Identity Verification as a Service

Fully digital identity verification for fast, secure user onboarding.

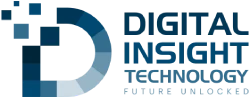

Our Process

Trust . Security. Compliance. Fraud Prevention

Data Collection

Document Verification

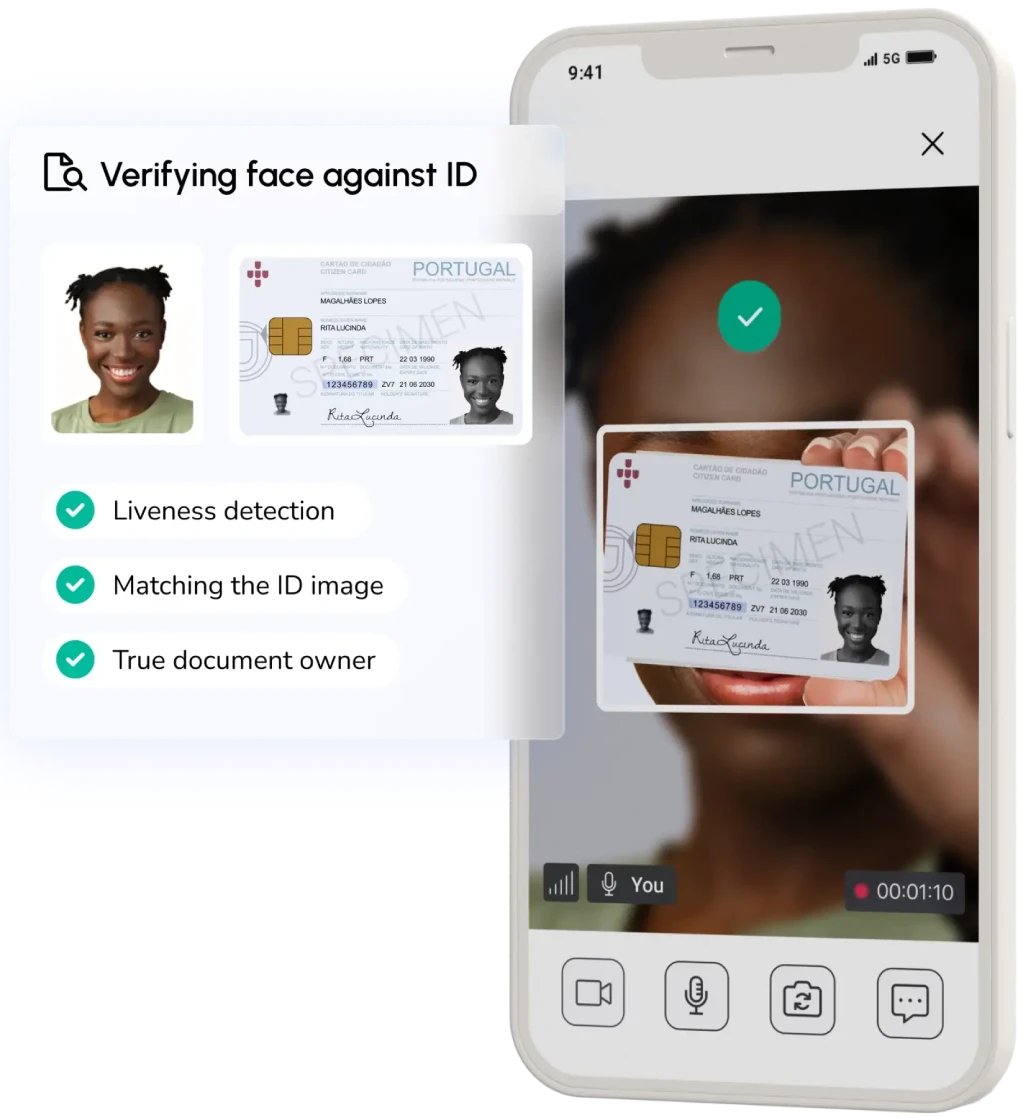

Biometric Verification

Data Cross-Verification

Final Confirmation

Identity Lifecycle Management

To learn more about how our solutions can help safeguard your business!

For organizations looking for an identity verification solution that goes beyond CIP and adds value with CDD, it’s essential to ensure that the vendor can connect to relevant data sources, such as checking identities against sanctions lists. The specific requirements for CDD may vary depending on local regulations. Many identity verification vendors and orchestration solutions now offer this connectivity.

If compliance with KYC and AML regulations is the goal, organizations should be cautious when engaging with vendors offering eKYC solutions. It’s crucial to carefully assess each vendor’s capabilities, given the complex and extensive scope of KYC and AML regulation.

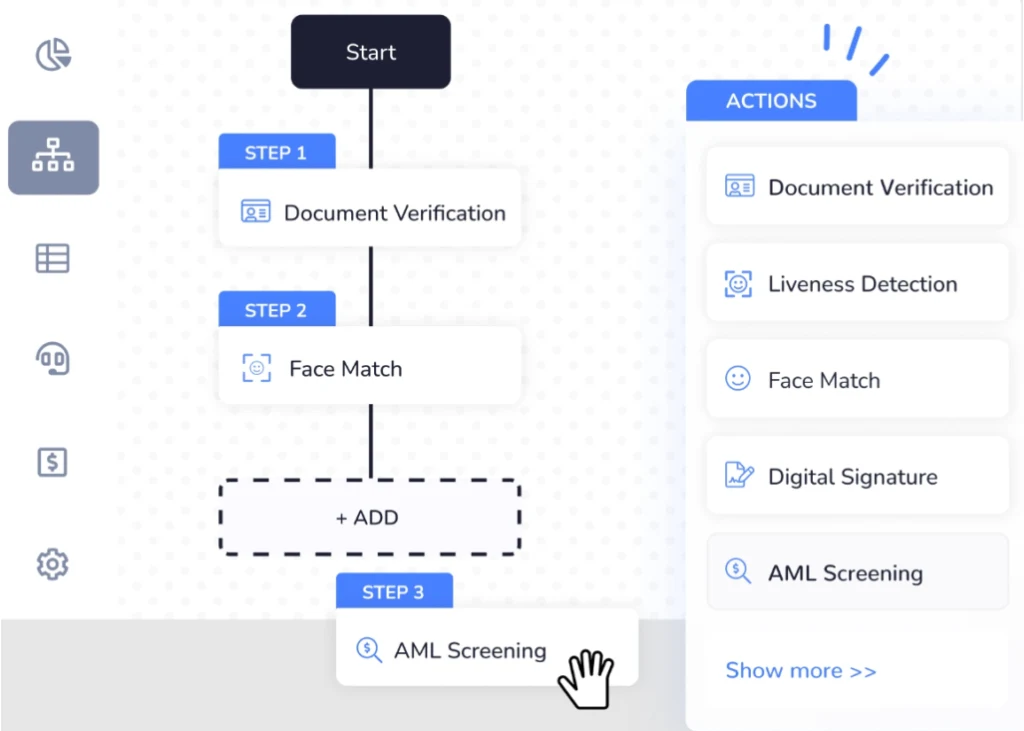

Know Your Customer Deeply (eKYC) Simplified

eKYC, or Electronic Know Your Customer, is the digital evolution of the traditional KYC process. It leverages technology to verify the identity of users electronically, reducing the need for physical presence or paper documentation.

Don’t hesitate to contact us with cell phone or live chat with our experts

Benefits of eKYC

Swift Onboarding

Cost-Effective

Enhanced Security

Global Compliance

User-Centric Experience

Adaptive Technology

Versatility

Integration Friendly

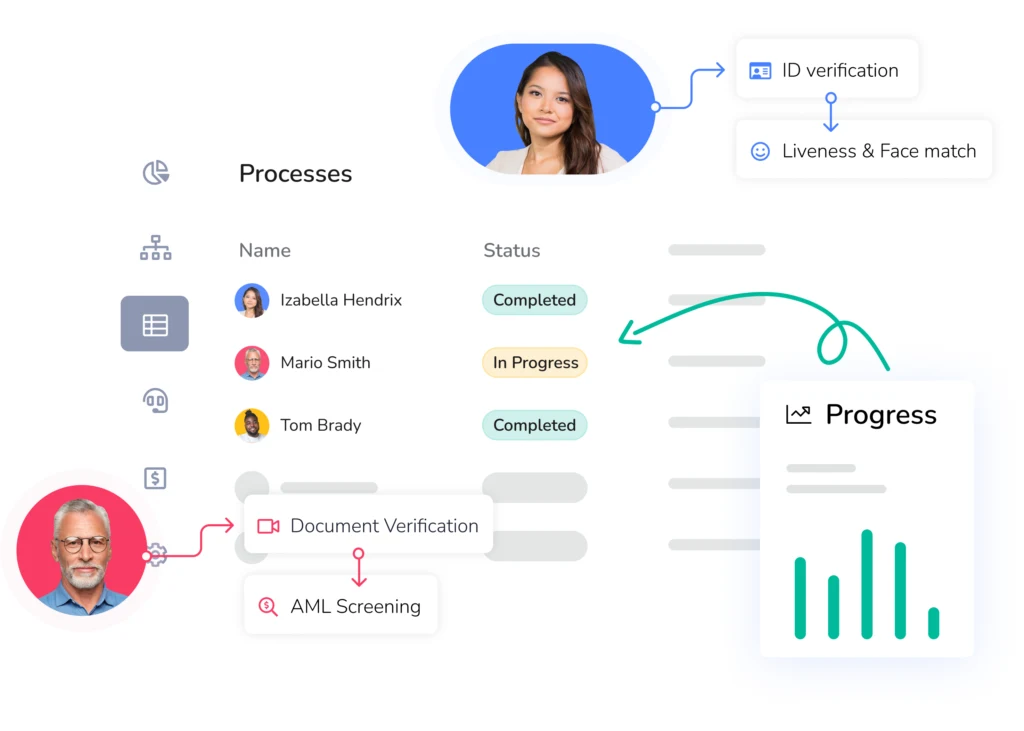

Our eKYC Process

Our eKYC solution streamlines the Know Your Customer process, ensuring that businesses can trust the digital identities of their customers

User Registration: Users provide basic information via a streamlined digital interface.

Saffeguarding Financial Integrity

Anti Money Laundering (AML)

In today’s global economy, financial transactions flow seamlessly across borders, making the detection of illicit activities more challenging. Our comprehensive Anti Money Laundering (AML) solutions ensure that businesses can confidently operate without the fear of being inadvertently linked to financial crimes.

What is Anti Money Laundering?

Anti Money Laundering refers to a set of procedures, laws, and regulations designed to halt the practice of generating income through illegal actions. By implementing effective AML measures, businesses and financial institutions can prevent and combat attempts to launder money and finance terrorism.

Why AML is Crucial:

- Legal Compliance: Adhering to global and regional AML regulations is not only ethical but also mandatory to avoid severe penalties.

- Protecting Reputation: Being associated with money laundering can severely tarnish a business’s reputation, leading to a loss of trust and clientele.

- Operational Integrity: Implementing robust AML measures ensures smoother, more trustworthy operations and partnerships.

- Economic Health: By combating financial crime, businesses contribute to a more stable and healthy global economy.

Trust in our state-of-the-art Anti Money Laundering solutions to shield your operations from illicit activities and ensure you stay on the right side of the law

Our AML Solutions

Key Features

Law Consultancy

Cutting-edge Technology

User-Friendly Interface